Comparison of Xero vs QuickBooks Online Authentic Analysis 2023

In this guide, we’ll compare Xero and QuickBooks head to head, looking at the pros and cons, features, fees and much more. Every business needs a good system for its accounts, from the smallest startup to the biggest multinational − not to mention freelancers. As your business grows — especially if you expand into other countries — you might be ready to make the switch to a more robust solution like NetSuite, which you can transition to from either software. QuickBooks Payroll is available as an add-on to any QuickBooks plan, or you can purchase it separately.

This feature helps businesses maintain healthy cash flow and improve overall invoicing efficiency. Whether you choose QuickBooks or Xero, Chargebee can sync your subscription management engine with your accounting software. Easily handle deferred revenue, generate invoices, streamline payments, and reconcile your bank account. QuickBooks Advanced plan users can access 24/7 phone and chat customer service. Other plans still have online chat and phone options, but the hours are more limited. Xero users can only track time if they have the highest-tier Established plan for $65 per month, whereas QuickBooks Online offers time tracking starting with the $55 per month Essentials plan.

Finally, we come to its $60 plan, where it allows you to track expenses and includes multiple currencies. The QuickBooks Online dashboard, as you can see below, includes all the information you need to get a quick overview of your financial transactions. The dashboard is programmed to display your invoices, expenses, bank accounts, profit and loss statement, sales, and time tracking. This article will break down the main differences between QuickBooks Online and Xero, two of the most popular accounting platforms for small businesses. We’ll give our recommendations of who each software is best for as well as directly compare each product’s pricing, features, usability, and customer service.

Best Accounting Software for Small Businesses

Its seamless integration with popular email platforms and comprehensive tracking capabilities make it the preferred choice for businesses seeking robust email tracking solutions. QuickBooks provides step-by-step instructions, making managing invoicing, tracking expenses, and generating financial reports easy. Even users with limited accounting knowledge can quickly become comfortable using QuickBooks.

So, if you are a newbie to the world of accounting software, Xero is the best choice. As an employee or a business owner, Xero will assist you to obtain real-time data about your company. QuickBooks Online is the top accounting software for small businesses due to its broad range of features and readily available customer support. QuickBooks Online pricing starts at $25 per month and goes up to $180 per month, making it one of the most expensive accounting platforms.

Next PostWhy Keep Receipts for Business Expenses?

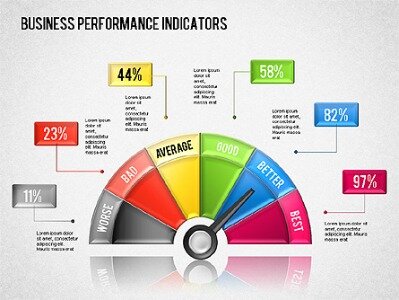

In contrast to Bookkeeper360, QuickBooks Live does not provide payroll services or tax filing. All Xero plans come with access to their inventory management system. This system allows you to add goods or services, keep track of inventory, make modifications, upload attachments, and add notes internally. After logging in, the excellent dashboards provided by Xero and QuickBooks allow you to view all of your key business indicators.

Let’s compare the features and benefits of QuickBooks and Xero free versions to help you make an informed decision. You can rely both on Xero and QuickBooks Online for project accounting, but if you want a more detailed option of tracking your profitability, then Xero may be better. Unlike QuickBooks Online, it allows you to compare estimated and actual project costs, which is crucial in budgeting. Xero and QuickBooks have similar pricing, except when it comes to QuickBooks Desktop.

Two of the most popular accounting software options for small businesses wanting to manage their money are Xero and QuickBooks. Both have extensive accounting features to assist you in managing complex business operations, including tax management, billing, financial reporting, and invoicing. We will take a closer look at each platform’s plans, user interface, inventory management features, tax tools, and app store integrations. You’ll learn about key differences between QuickBooks Online and Xero that could impact your decision-making process when choosing an accounting solution.

- When comparing Xero vs Quickbooks Online, it’s important to consider factors such as ease of use, integrations, reporting capabilities, customer support options and mobile accessibility.

- We compared Xero and QuickBooks in a variety of accounting categories and saw significant differences in bank reconciliation and fixed-asset accounting.

- If you need comprehensive bank reconciliation, class and location tracking, good customer support, and easy access to local bookkeepers, then QuickBooks Online wins.

- It’s tempting to go for the cheapest plan, but this could mean having to pay extra for the add-on features your business needs.

- Host Merchant Services is a registered Independent Sales Organization of Wells Fargo Bank, N.A., Concord, CA.

- Ultimately, when deciding between Xero vs. QuickBooks, it depends on the complexity and size of your business.

But they have faced issues with their mobile application and recent pricing plans have created some discontentment among the users. Overall, it has received high ratings on all major platforms such as Play Store, G2Crowd and GetApp. However, the key limitation of QBO’s Simple Start is that it only allows access for one user.

Xero doesn’t have built-in payroll functionality, but you have the option to add on Payroll with Gusto for an additional $39 per month on any plan. Because they cater to companies in different global regions, Xero and QuickBooks specialize in meeting different standards for accounting and financial reporting. One of the things many people like with Xero is that it doesn’t require you to reconcile bank accounts in the same way QBO does. Some accountants like that reconciliations are more automatic with Xero, but some hate the loss of control. This is really a personal preference and not a true difference in functionality.

Around 800 top business software programs are integrated with Xero, including MailChimp, HubSpot, Microsoft Outlook, Paypal, Google Contacts, and many others. Additionally, it utilizes Zapier to integrate with thousands of well-known apps available in the market. Each category’s spend can be easily customized, managed, and tracked using the chart of accounts. Before registering for one of its packages, you may test the software and look at its features with its 30-day free trial offer. You can use a demo company during sign-up if you don’t want to upload personal data. For $34 each month, you can enter bills, issue invoices and quotes, and reconcile bank transactions.

Basic inventory tracking in all plans

For example, when you purchase the Pro Plus Desktop plan, you can have up to three concurrent users but each of those users must pay for their own account (at $349.99 each per year). Its Online version allows up to 25 users at no additional cost, provided you’re paying for the Advanced plan. Includes audit trails and easy accountant access; has millions of users so your accountant will likely be familiar with it.

Ratings are based on weighted averages of scores in several categories, including scope of features and integrations, customer support and cost, among others. Xero is another top option because it offers a similar set of features for a lower cost. Xero does not offer accounting or bookkeeping services, which QuickBooks Online does, but otherwise the features are relatively equal. Regardless, Xero is a fantastic choice for those who want one of the most powerful accounting software tools for a reasonable price. The Xero mobile app is for Android and iOS devices is free when you sign up for a subscription.

QuickBooks Cons

The winner between QuickBooks and Xero depends on the specific needs and budget of your business. However, Xero’s plans are the cheapest, suitable for self-employed and small business accounting operations. Even better, inventory management is available at no additional charge with every Xero plan, which is why we declared Xero the winner for this particular category. While Xero doesn’t offer its own U.S.-based payroll plan, it syncs seamlessly with the payroll provider Gusto, as well as other popular payroll services like ADP and Paychex. Integrating Xero with Gusto ensures that your general ledger will update automatically whenever you process payroll. Yes, Xero has a fixed assets manager that allows you to track fixed assets and calculate depreciation.

Both Xero and QuickBooks Online are robust accounting software solutions, and in this article, they prove why they stand out as the best options available. Despite having incredibly similar features, every application has unique strengths and limitations. Businesses that need desktop accounting software and outsource their accounting work to a bookkeeper or accountant are best served Is purchase return a debit or credit by QuickBooks. In contrast, organizations that require online accounting software and unlimited users are better served by Xero. When evaluating accounting software, the quality of customer service can be a significant factor in determining the best choice for small businesses. QuickBooks is also recognized for its extensive functionality and comprehensive set of features.

Accounts Payable

Xero also offers slightly more refined functionality, including the ability to sync bank transactions for automatic bank reconciliation. When it comes to getting help from an actual customer support rep, good luck! Xero’s customer support can only be contacted through email, or you can request for them to call you. QBO has a phone-line for their customer support, in addition in email and online chats.

QuickBooks Online

We evaluated the features, pricing and customer support offered by both QuickBooks and Xero. We also set up trial accounts to get hands-on experience with both products and determine their user-friendliness for ourselves. QuickBooks is a popular accounting software used by small businesses, solopreneurs and freelancers. The software helps users to keep track of their finances, customers and vendors. QuickBooks Online is an excellent choice for most small businesses, given that it’s the best accounting software on the market. With all features a small business could need for accounting, as well as live bookkeeping services, the tool is a one-stop shop and is the most established accounting platform.

Cevapla

Want to join the discussion?Feel free to contribute!